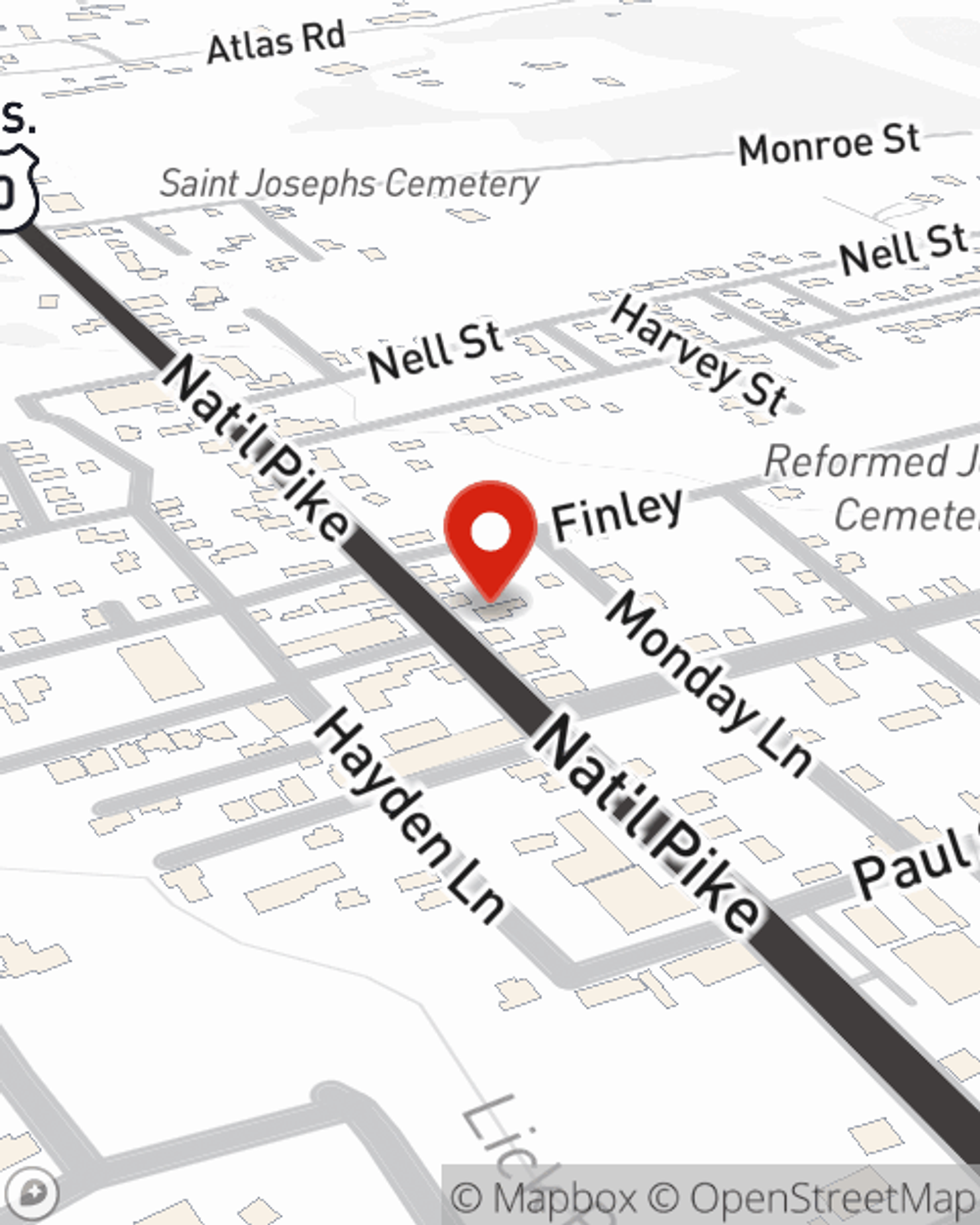

Condo Insurance in and around Hopwood

Condo unitowners of Hopwood, State Farm has you covered.

Insure your condo with State Farm today

- Hopwood, PA

- Uniontown, PA

- Fayette County, PA

- Morgantown, WV

- Cheat Lake, WV

- Pittsburgh, PA

- Washington, PA

- Waynesburg, PA

- Fairchance, PA

- Smithfield, PA

- Masontown, PA

- McClellandtown, PA

- Farmington, PA

- Chalkhill, PA

- Markleysburg, PA

- Lemont Furnace, PA

- Connellsville, PA

- Point Marion, PA

- Brownsville, PA

- California, PA

- Belle Vernon, PA

- Perryopolis, PA

- Leith-Hatfield, PA

- Oliver, PA

Home Is Where Your Heart Is

When considering different savings options, liability amounts, and coverage options for your condo insurance, don't miss checking out the options that State Farm offers. These coverage options can help protect not only your condo unit but also your personal belongings within, including furnishings, pictures, mementos, and more.

Condo unitowners of Hopwood, State Farm has you covered.

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

Everyone knows having condominium unitowners insurance is essential in case of a tornado, hailstorm or blizzard. The right amount of condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t stuck making payments for a home you can’t occupy. Another helpful thing about condo unitowners insurance is its ability to protect you in certain legal situations. If someone has an accident in your home, you could be required to pay for physical therapy or their lost wages. With enough condo coverage, you have liability protection in the event of a covered claim.

Intrigued? Agent Cameron Miller can help outline your options so you can choose the right level of coverage. Simply reach out today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Cameron at (724) 437-1591 or visit our FAQ page.

Simple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Cameron Miller

State Farm® Insurance AgentSimple Insights®

Is bundling insurance worth it?

Is bundling insurance worth it?

Bundling insurance, such as auto and home, can be a great way to get discounts, but that’s not all! Discover why bundling makes sense for savings and more.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.